Non-life alternative reinsurance capital rises 6% to $113bn in H1 2024: Gallagher Re

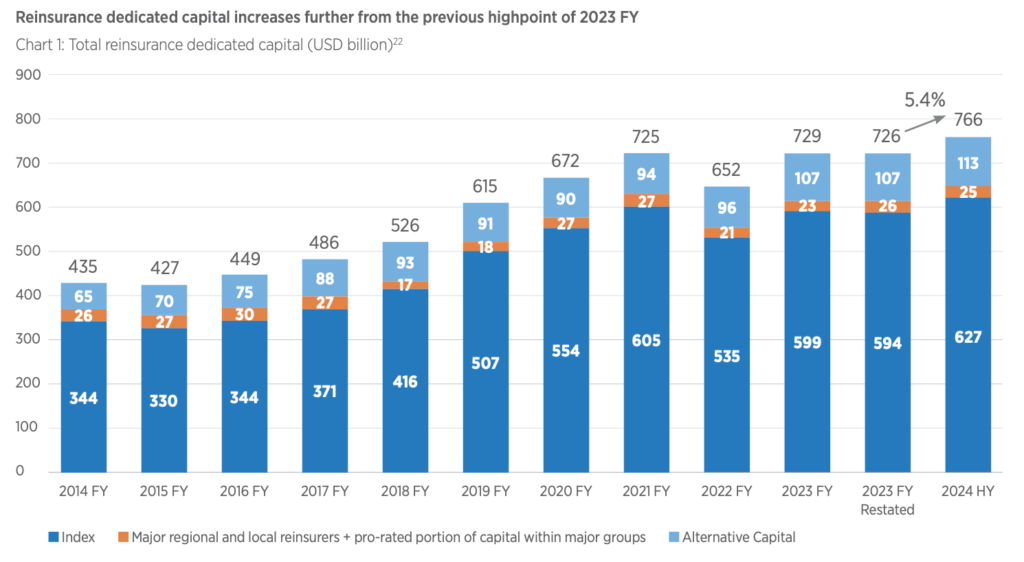

Continued high earnings from returns and fresh inflows in the catastrophe bond and insurance-linked securities (ILS) market have driven non-life alternative reinsurance capital up a further 6% to a new high of $113 billion by the middle of this year, broker Gallagher Re has said.

It puts non-life alternative reinsurance capital now 14% higher than mid-year 2023, based on Gallagher Re’s figures, as the broker had reported it at $99 billion at the end of June 2023.

Then, non-life alternative reinsurance capital had grown by 11.5% to another record at $107 billion as of the end of 2023, according to the broker.

Now, a further almost 6% in growth has taken the total to a record-high of $113 billion, by June 30th 2024.

The rising capitalisation of the global reinsurance industry, standing at $766 billion at the mid-year, is has further strengthened the industry’s resilience, Gallagher Re explained today.

The growth of non-life alternative capital has outpaced all other reinsurance capital sources, on a percentage basis, over the first-half of 2024, according to Gallagher Re’s data.

Reinsurance capital of the index of companies the broker tracks plus major regional and local reinsurers has risen by 5.2% in the period, so at a slower pace than the capital base of the cat bond and ILS market.

Gallagher Re said, “This growth, plus an exceptional reported return on equity (ROE) driven by further improvement in underwriting profitability and a higher investment yield, provide the reinsurance industry with an ample buffer to absorb losses from potential headwinds such as an active hurricane season or lower interest rates.”

Interestingly, with exceptional returns on equity (ROE’s) earned by reinsurers, Gallagher Re said that, “As a result of the significant improvement in profitability over the past two years, the industry has fully recouped for weaker profit years (2017-2020) and earned a margin on top of the cost of capital.”

ROE’s have “stabilised at an exceptional level of 19.6%” while the underlying continues to increase, the reinsurance broker said.

While the subset of reinsurers the broker tracks saw their ROE of 15.5% in the first-half of 2024 meaning they have “surpassed the cost of capital for the third consecutive year, pointing to better underlying underwriting margins and higher investment income,” Gallagher Re said.

“Global reinsurers delivered another strong set of results in the first half of 2024,” explained Michael van Wegen, Head of Client & Market Insights International, Gallagher Re Global Strategic Advisory. “With ROEs continuing to sit comfortably above the cost of capital, reinsurers are in an extremely healthy position to absorb any potential volatility arising from for example, natural catastrophes, financial markets or interest rates.”

Drivers of the growth in alternative reinsurance capital were increased earnings and capital inflows, with Gallagher Re saying that “Much of the growth came in catastrophe bond mandates.”

However, the reinsurance broker also noted that new company formation continues to be absent from reinsurance, saying, “We continue to see a lack of new entrants despite continued favorable market conditions.”